does massachusetts have an estate or inheritance tax

Interestingly at least to those who work in this field unlike the federal estate tax which only taxes the amount over the threshold for taxation if a Massachusetts estate. Massachusetts has an estate tax.

A Guide To Estate Taxes Mass Gov

It is still important.

. Inheritance tax is a state tax paid by a beneficiary on the value of what they received as an inheritance. Inheritance tax is a state tax paid by a beneficiary on the value of what they received as an inheritance. Therefore a Massachusetts estate tax return is required because the sum of the decedents gross estate at death and the adjusted taxable lifetime gifts exceeds 1000000.

Massachusetts has no inheritance tax. If you are feeling motivated here is the Massachusetts Department of Revenue Guide to the estate tax. The Legacy and Succession Tax RSA 86 was repealed effective for deaths occurring on or after January 1.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. The Massachusetts estate tax exemption is 1M. Massachusetts has an estate.

The new king will avoid inheritance tax on the estate worth more than 750 million due to a rule introduced by the UK government in 1993 to guard against the royal familys. If the estate is worth less than 1000000 you dont need to file a return or. Massachusetts and Oregon have.

A recent report from the Tax Foundation says in 2022 there are 12 states and DC with an inheritance or estate tax with one state Maryland having both. It also does not have a gift tax. Fortunately Massachusetts does not levy an inheritance tax.

When you die if your estate is valued at 1M or under you pay no estate tax. Massachusetts has an estate tax but not an inheritance tax. But if you inherit money or assets from someone who lived in another state make.

Legacy and Succession Tax. Fortunately Massachusetts does not levy an inheritance tax. M-F 800 AM to 430 PM.

A recent report from the Tax Foundation says in 2022 there are 12 states and DC with an inheritance or estate tax with one state Maryland having both. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the.

Death And Taxes Front And Center In Massachusetts

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

What Is The Estate Tax In Massachusetts Massachusetts Probate Law Mcnamara Yates P C

Massachusetts Should Focus On Building An Equitable Recovery Not Tax Cuts For The Wealthy Center On Budget And Policy Priorities

Massachusetts Estate Tax Everything You Need To Know Smartasset

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

What Inheritance Taxes Do I Have To Pay The Heritage Law Center Llc

Closing Lawyer Massachusetts Moody Knoth Estate Planning Home Mortgage Residential Real Estate

Inheritance Tax And Your Massachusetts Estate Plan Slnlaw

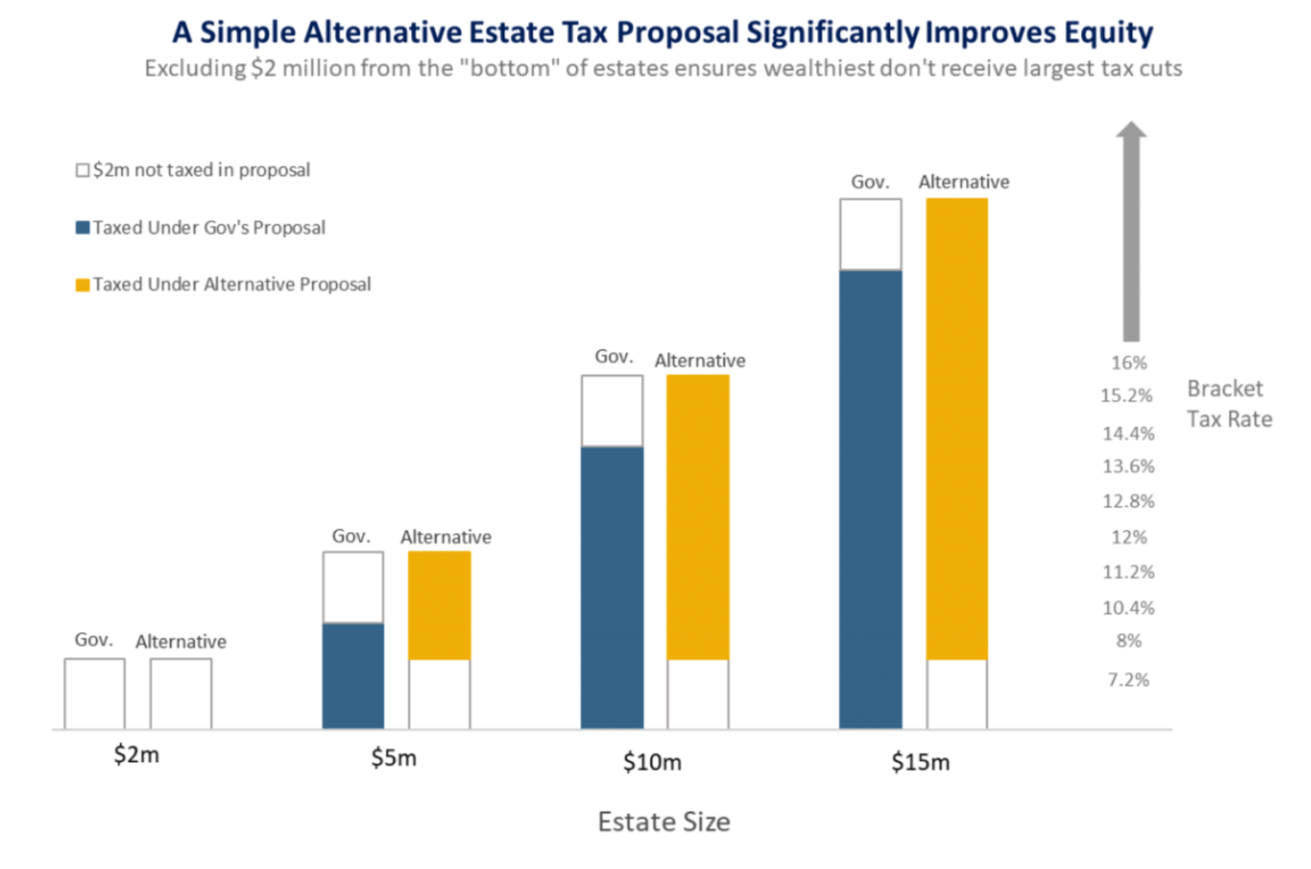

Current Estate Tax Proposals Would Give Largest Benefits To Wealthiest Estates Alternative Method Would Fix This Problem Mass Budget And Policy Center

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

Massachusetts Estate Tax Everything You Need To Know Smartasset

Gov Charlie Baker Optimistic About Nearly 700 Million In Tax Break Proposals Including Changes To Massachusetts Estate Tax Masslive Com

Massachusetts Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities